Have you ever wondered if it’s truly possible to achieve a 6x return on your investments? While it might sound like a dream, multiplying your money sixfold through Real Estate Investment Trusts (REITs) may be within reach. In this comprehensive guide, we’ll unravel the secrets, strategies, and risks associated with potentially achieving this impressive feat in the real estate market.

Understanding the Power of Money 6x REIT Holdings:

Before diving into the Money 6x REIT Holdings potential, let’s understand the basics of REITs. These investment vehicles pool funds from multiple investors to purchase and manage income-generating real estate properties. As a REIT investor, you essentially own a share of this portfolio, earning a portion of the rental income and any property appreciation. Acura of Overland Park

Why REITs Are Appealing:

- Diversification: REITs offer instant diversification across various property types (residential, commercial, industrial, etc.).

- Liquidity: REITs are publicly traded, making it easy to buy and sell shares.

- Professional Management: Your investments are handled by experienced real estate professionals.

- Regular Income: REITs are required to distribute at least 90% of their taxable income to shareholders as dividends.

Factors That Drive 6x Returns on REITs:

So, how does one achieve a Money 6x REIT Holdings? While not guaranteed, several factors can contribute to this impressive growth:

- Property Appreciation: Over time, the value of real estate properties tends to appreciate, leading to capital gains.

- Dividend Reinvestment: By reinvesting dividends, you compound your returns over time, purchasing more shares and generating even more income.

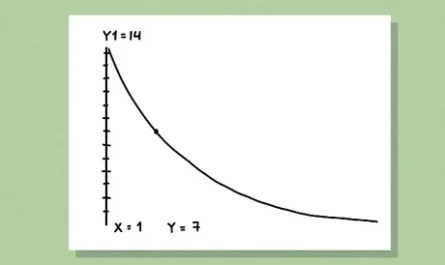

- Compounding: The snowball effect of reinvesting dividends and capital gains leads to exponential growth over the long term.

Strategies to Unlock 6x Potential:

To maximize your chances of reaching a Money 6x REIT Holdings return, consider these expert strategies:

- Research and Due Diligence: Carefully analyze REITs based on their track record, financial health, dividend history, and growth prospects.

- Diversification: Spread your investments across different REIT sectors (e.g., healthcare, retail, data centers) to mitigate risks.

- Long-Term Perspective: Adopt a long-term investment horizon. REITs tend to perform best over extended periods, allowing compounding to work its magic.

Mitigating Risks in Your REIT Portfolio:

While the potential for high returns is enticing, it’s crucial to acknowledge the risks associated with REIT investing:

- Market Volatility: Real estate markets can experience fluctuations, impacting REIT prices.

- Interest Rate Risk: Changes in interest rates can affect the cost of borrowing for REITs and investor sentiment.

- Property-Specific Risks: Factors like vacancies, natural disasters, or changes in local regulations can impact a specific REIT’s performance.

Diversification and thorough research can help manage these risks, but they are inherent to investing in real estate.

The 6x REIT Formula: A Summary

Achieving a 6x return on REIT investments isn’t a get-rich-quick scheme. It requires:

- In-Depth Research: Choose high-quality, well-managed REITs with strong growth potential.

- Strategic Diversification: Build a portfolio that spans different sectors and geographic locations.

- Patience and Discipline: Stay invested for the long haul, reinvesting dividends, and weathering market fluctuations.

Conclusion:

While a Money 6x REIT Holdings return on your money through REITs is a possibility, it’s not guaranteed. It takes careful planning, research, and a long-term commitment. By understanding the fundamentals of REITs, employing smart strategies, and managing risks, you can position yourself for potentially significant wealth creation in the real estate market.

Remember, investing always carries risk, and past performance is not indicative of future results. Always do your own research and consider consulting with a financial advisor before making any investment decisions.